It’s looking like I can’t tap into the kind of funds I’d like to get without taking those disgusting credit cards after all. Before I give in to the whole CC thing, I’d like to share some more information on why I don’t want to take credit cards and what I’ll have to do as a very small business owner to deal with the increased cost of business that card-taking entails.

First of all, credit cards take a cut starting at about as low as 1.7% but typically higher, depending on the conditions of the sale and type of card. “Rewards cards” that give extras such as, say, 1% of the purchase price back to the purchaser work by taking that 1% away from the company that makes the sale. If I take a normal card for a $100 item, I may lose 1.8% plus a flat $0.20 transaction fee, giving me $98.00 instead; with a 1% back rewards card, I would instead lose an additional 1%, meaning I get only $97 instead of $100 for the $100 item. Because of these kinds of oddities, it’s almost impossible to determine how much each kind of card costs to process, and therefore how much higher prices must go to compensate (we’ll get into that in a minute.)

One of the newer trends in the banking industry is to give you a phenomenally high-interest account in exchange for swiping your card as credit a certain number of minimum times a month. You could get an extra 2% interest or so if you swipe your VISA debit card as a credit card at least seven times a month! Every swipe takes money from me, the business owner, and gives part of it to you via the higher interest rate, and part of it to the bank to make such a program profitable. You are being actively encouraged to pay as credit, and therefore actively encouraged to rip off the businesses for a few percent of every transaction! This kind of thing is absolutely dirty, and does not actually benefit anyone but the bank, because the net result is a price inflation at retailers to compensate for the additional loss to the CC companies. That 2% interest is more than gobbled back up in the form of additional inflation across the board.

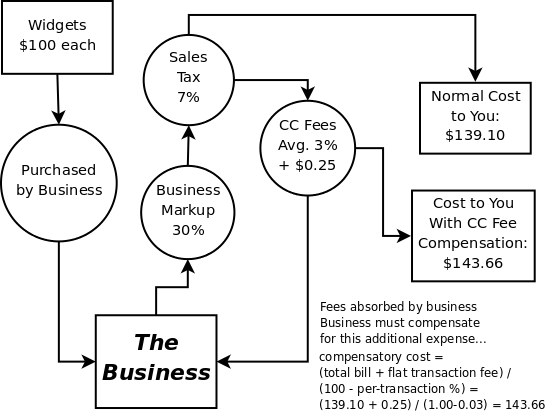

It helps to look at any typical for-profit business as some kind of a machine. It exists solely to make money for its creators or shareholders. If the business incurs an expense of some sort, it has to repackage that expense into the price it charges to you in order to continue making money at the same rate it was before that expense showed up. If credit card fees take $300 per month out of monthly profits, the $300 per month has to be rolled into the cost of each product. How does this work? The formula is easily found with some simple algebra:

Final cost with CC compensation included =

(Total billed to customer + flat transaction fee) / (100% – average per-transaction % fee)

Plug in values as desired. For a $3,000 (would-be retail price to you) high-definition television with 7% retail sales tax charged to a rewards card at 4% + a flat $0.30 transaction fee, the business has to compensate for your credit card transaction costs by jacking up the price as follows:

($3000 + $0.30) / (1.00 – 0.04) = 3000.30 / 0.96 = $3,125.3125 =

$3,125.32.

But if you don’t use a credit card, who cares? You do, because credit card companies have a clause in their contracts with merchants that explicitly prohibit charging any kind of additional fee to take credit cards.

That means that, even as a cash-paying customer, a merchant has to spread the credit card “cost of doing business” across all of their products and services. They can’t show card users that card users directly hurt the business every time they swipe a credit card, because that would discourage the use of credit cards and the contract says that’s not allowed. You, the cash-paying customer, are punished for the credit card users’ costs to the business you’re buying from. Isn’t that wonderful? (end sarcasm)

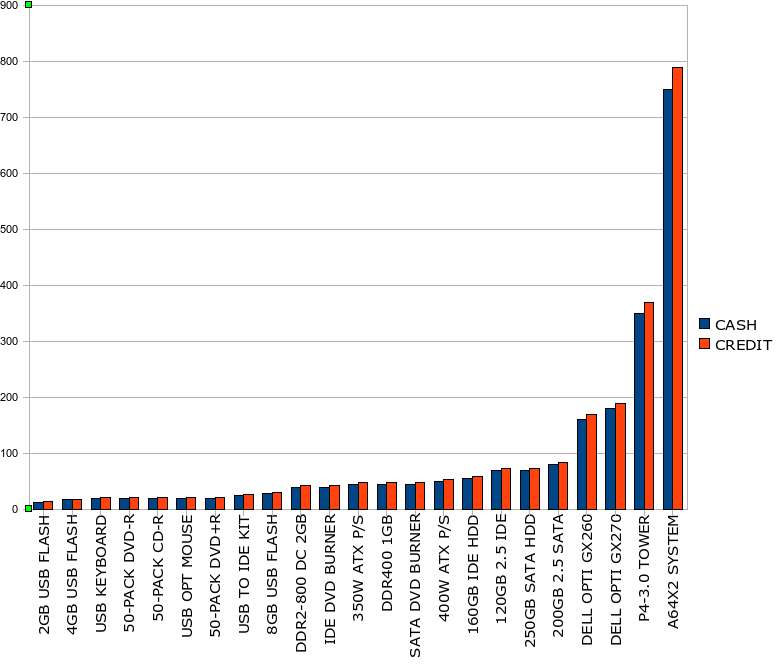

Ultimately, what this means to my business and my customers is that I will have no choice but to increase prices in anticipation of approximately 40%-50% of my sales becoming credit cards. I’ve actually taken the time to produce a chart of actual prices of some of my store items, from cheap stuff like USB flash drives to entire computers, and how much I will have to boost my prices to compensate, per the above formula. I assume a 5% rate because with a rewards card and/or large purchase amounts, the rates increase significantly and 5% is not unheard of by any means.

It doesn’t look like much at all when you’re dealing with a $13 2GB USB flash drive (the formula I used tacks on $0.89 in my spreadsheet), but the story starts to change when you reach larger orders and higher prices. Our display-model computer system, a brand new and complete unit designed to demonstrate what we can build for a customer, sells for $750. The formula spits out $789.68 as the new retail price I’d have to charge if I start taking cards. That’s basically $40 extra for whoever buys the system! If the person is getting an extra 2% interest for swiping their card seven times a month, and they have $20,000 in savings, I just charged them an entire month’s additional 2% interest on their savings account for that one purchase! The problem is that I’d have to charge a cash-paying customer the exact same amount because the credit card companies won’t let me take cards at all if I discriminate against their credit cards versus other payment methods. Granted, there’s the “cash discount” method, where you offer a discount for cash purchases, but that puts you in a grey zone where the CC company COULD say that the cash discount is simply a surcharge by another name, and therefore violates your agreement anyway. It’s not like you can stop them from terminating your contract with them if you don’t do what they want, after all!

I don’t understand why an average person can be so oblivious–sometimes perhaps even downright ignorant–of “reality as marketed” versus true reality! If it’s enumerated on a receipt: sales tax, food tax, bottle recycling tax, core charge for an auto part, battery disposal surcharge, government usage surcharge, 911 surcharge, property tax, vehicle tax–people soil their underpants over it, but if the same costs to them are hidden from them–payroll tax, unemployment tax, business liability insurance, “business-class Internet access” (often lower quality than the same residential access, yet for three times the price), income tax matching, and credit card fees–people will happily go along being ripped off. This is why the government can get away with “we’ll tax the very rich to pay for everything we want to do!” as their excuse for any new government program or expansion of an existing one–no one considers the fact that the ultimate burden to pay those taxes falls on the consumers of a business’s products or services, because the “very rich guy” who runs the company rolls that $125,000-per-year tax on his income into the cost of the products the company sells…but you never know that this has happened and you go on, happily thinking that Joe C.E.O. is paying for your “free clinic” or your “basketball museum” or “free visit to the emergency room” or whatever other “freebie” you’re getting. Pay no attention to the embedded costs hiding behind the curtain! Never mind the fact that you’re still paying for the “free” stuff, but the payment you’re making is now hidden and not explicitly stated on a receipt!

Unbelievable.

The next time you swipe a credit card (or vote for a politician that claims an intent to “tax the rich and give back to the middle class” as both recent major Presidential candidates chose to position themselves), remember that you’re the reason that $3,125 television you just bought didn’t cost $125 less. What can you do with $125? Maybe buy a Blu-Ray player to hook to said new television? Perhaps buy some movies or speakers?

Too bad.

You swiped those away. But it was so convenient, wasn’t it? And you get a “free” *cough*cough* flight to Hawaii in a year off your rewards points, too! Yay!

Please educate yourself on what you’re really paying for when you buy something. Ask any small business owner: “do you have to charge extra on all your products because of the fact that you accept cards?” You’ll probably get some very consistent responses…or find a business owner that isn’t going to be in business much longer.